CECL (Current Expected Credit Losses) implementation may seem scary at first regarding the time for implementation, lack of specific regulatory guidelines and potential impact on allowance for loan-lease losses. During our recent webinar, our partners at KPMG discussed the big banks’ experience with it thus far, which the audit firm expects to carry over into community financial institutions, and the impact of COVID-19, along with the CECL Survey shared by Reza Van Roosmalen and Emily De Revere of KPMG. Some of the early data may surprise you.

To watch the “Achieving CECL Embedded Credit Enhancement Webinar” and download the accompanying slides, click here!

Management And Concerns Addressed By CECL

CECL was created in response to the Great Recession of 2008 for the purpose of better predicting credit losses before it’s too late. Using historical loss data and taking into account current economic conditions and forecasts, FASB feels a financial institution has a clearer picture to estimate its expected credit losses.

There are five main areas of change when it comes to the CECL model:

- Allowance reduces the amortized cost amounts expected to be collected

- No recognition threshold

- A lifetime loss estimate

- Need to estimate future economic conditions and the length of the reasonable and supportable forecast period

- Application to HTM debt securities

KPMG’s Q4 2020 CECL Survey

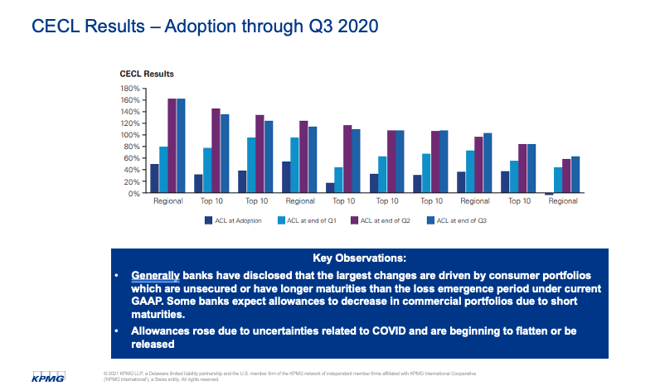

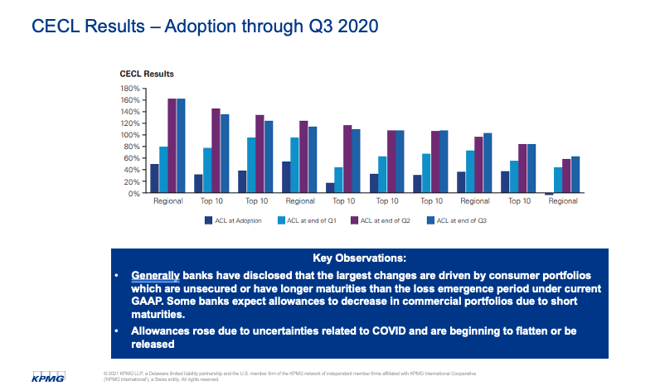

KPMG surveyed 30 banks and 7 consumer finance companies to understand what their response has been to the changes in CECL due to the coronavirus pandemic. A key observation it found is that allowance accounts did rise, in part due to COVID-related uncertainties. As time has gone on, they have begun to flatten. It also found that the largest driver of change in allowance balance during Q4 was changes to expectations about the future economy.

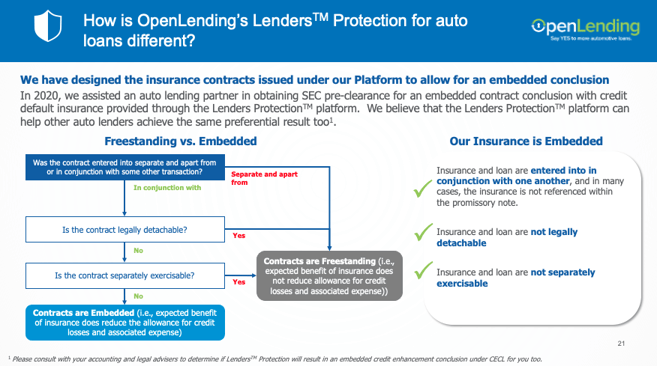

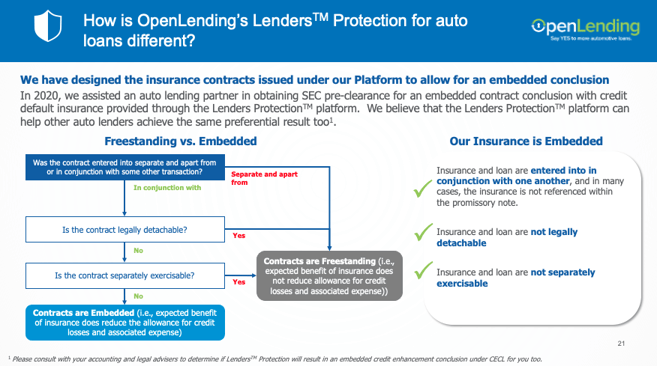

Embedded Credit Enhancements

Embedded credit enhancements can allow lenders to avoid some of the allowance requirements under CECL. When they are embedded – essentially part of the default insurance product – banks and credit unions are able to:

- Reflect allowances as net of expected insurance recoveries. Insurance recoveries are not accounted for separately; they are included within the allowance.

- Align allowance to the net amount expected to be collected from all relevant sources.

- Develop more relevant and useful credit loss metrics because they are more closely correlated to the lender’s inherent credit risk.

Open Lending’s Lenders Protection™ checks all the boxes for embedded credit enhancement, allowing your bank or credit union to minimize the impact of CECL to your ALLL. We’ll even assist with documentation we’ve developed and proven to obtain approval!

To learn more, contact one of our knowledgeable representatives today!