Interest income is critical for financial institutions, and yet it is becoming increasingly difficult to come by. Interest margins have been declining for years, and banks and credit unions have been feeling the pinch. To reverse this trend, change your bank's or credit union’s lending strategy.

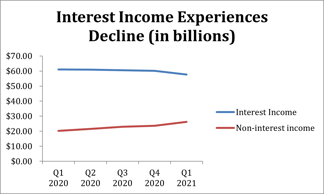

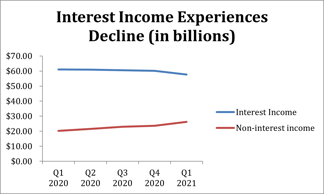

According to the NCUA’s Q1 2021 Quarterly Data Summary, interest income declined by $3.2 billion, or 5.3%, from $61.1 billion Q1 2020 to $57.7 billion. Throughout 2020 and into 2021, while interest income saw a steady decrease, non-interest income slowly began increasing, with much of that growth in Q4 2020 and Q1 2021 coming from growth in other operating income.

According to the NCUA’s Q1 2021 Quarterly Data Summary, interest income declined by $3.2 billion, or 5.3%, from $61.1 billion Q1 2020 to $57.7 billion. Throughout 2020 and into 2021, while interest income saw a steady decrease, non-interest income slowly began increasing, with much of that growth in Q4 2020 and Q1 2021 coming from growth in other operating income.

One potential solution to help reverse the current interest income trend is through diversifying your lending portfolio through nonprime auto loans. While the auto market continues to face challenges regarding inventory in both the new and used sectors, it doesn’t change the fact that many people in the United States are in need of a car, but are struggling to afford them due to increasing prices, as well as their own credit issues.

According to a report from Forbes, Experian Automotive found that borrowers with subprime credit continue to get squeezed out of new-and used-vehicle loans. While non-prime borrowers are able to fair better due to having slightly higher credit scores, they too can struggle to get the financing they need. Banks and credit unions can help these borrowers, but this can come with additional risk to their portfolios. There is a way to take on additional loans with these types of borrowers, and that is Lenders Protection™ from Open Lending.

Lenders Protection™ allows banks and credit unions to take on more nonprime auto loans without adding significant risk to their lending portfolio. We help you structure your pricing appropriately, so your financial institution can hit its target ROA. The Lenders Protection™ data analytics can accomplish this safely, and we back loans made through our program with default insurance. These are risk mitigation tactics that work for you to increase interest income while continuing to offer affordable car loans to car buyers with less-than-perfect credit.

Learn more about Lenders Protection™ from Open Lending and schedule a demo by clicking here!

According to the

According to the