Indirect auto lending can generate massive financial growth, particularly if you dip into members with lower credit scores, but if credit unions do not get them using more products the relationship could be short lived, particularly since the average life of an auto loan at a credit union is about two years. Therefore, we must work harder to convert them into power users for years to come.

It’s the old wants versus needs conundrum from the consumers point of view. Consumers want to hang their family portrait, but to do so, they need to buy a hammer; they don’t necessarily want a hammer. Same thing for auto loans: Consumers want a particular car, and they need a loan to fulfill their want.

The borrower has already gotten a taste of the value of your credit union, now you need a plan to open their eyes to the rest of what you have to offer.

Car loans, particularly used ones, have been the bread and butter of credit unions for decades. Plus, credit unions are known for helping out members who have near- or nonprime credit scores. Since the economic crisis in the late 2000s, they have leveraged indirect relationships to build their auto loan portfolio at almost double the rate of banks, according to CU Journal, primarily driven by indirect auto lending, which is forecast to continue its growth trajectory even as direct loans slow. Additionally, Bain research shows that a consumer’s primary financial institution receives 64% of their business, which is why it’s so critical to convert these members to using multiple products.

Before attempting to reach out to members who’ve come in through indirect auto loans, ensure your products and services are able to meet their needs. Get to know these members through the data you already have about them. Did they move recently? Life events, such as moving for a new job or having a baby, provide great information to better personalize your offers. Do they have credit cards or other car loans at higher rates that you can offer to refinance? Keep in mind, a TeleVox study reported credit unions had the highest levels of success converting indirect members with a line of credit (28% conversion), credit cards (17%) and other auto refinancing (15%).

Your messaging also has to align with their goals. An auto loan refinance offer featuring a sports car may not make sense if they have a minivan they use to haul their kids around to soccer practice. That doesn’t mean each offer has to be truly unique, but I guarantee you they aren’t the only ones at this point in their life, so build personas from among your members to create more meaningful messaging.

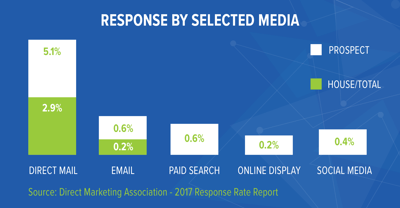

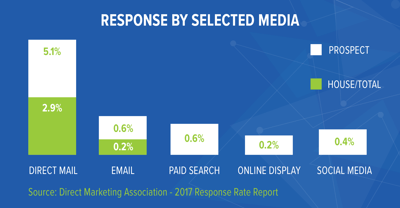

Integrated marketing campaigns are most effective, especially in the first 90 days, for cross-selling opportunities. TeleVox’ report recommends reaching out three to four times during that period. Integrated marketing means using all types of media to get your message across in a consistent manner. And while digital marketing is all the rave now, direct mail remains king among response rates. Use a mix of direct mail, email, digital and telemarketing to reach them.

Integrated marketing campaigns are most effective, especially in the first 90 days, for cross-selling opportunities. TeleVox’ report recommends reaching out three to four times during that period. Integrated marketing means using all types of media to get your message across in a consistent manner. And while digital marketing is all the rave now, direct mail remains king among response rates. Use a mix of direct mail, email, digital and telemarketing to reach them.

Once you bring in a new member through an indirect auto loan, hit them fast and relatively frequently with targeted offers to help them make their lives easier. Remember, they’re not looking for a lender – they’re looking for a partner that can fulfill their needs to help them achieve their ‘wants.’ They already need a financial institution, so make them want yours!