Even as more people get vaccinated for the coronavirus, buying a car is still tricky business for many consumers. Despite setbacks in the still recovering economy and within the automotive industry, there are still reasons to be optimistic for the future of auto lending during the rest of 2021, and financial institutions need to get the word out that should someone want to buy a car now or in the near future, their bank or credit union is here to help.

Why Are Consumers Wary?

The global pandemic was a big reason consumers avoided buying cars over the past year, but as fears of the virus begin to wane alongside increased vaccination, the main reasons people are avoiding purchasing a car now are rising prices and fears about one’s employment, in particular, getting laid off, according to a TrueCar Inc. survey reported by the Credit Union Times. The price increases have been attributed to a shortage of car parts, which in turn is leading to an inventory crunch. At the moment, although there are those whose need for a car has increased due to the pandemic, many potential car buyers are holding off making a purchase until they can get the car they want at an affordable price.

Decreasing Auto Loan Rates

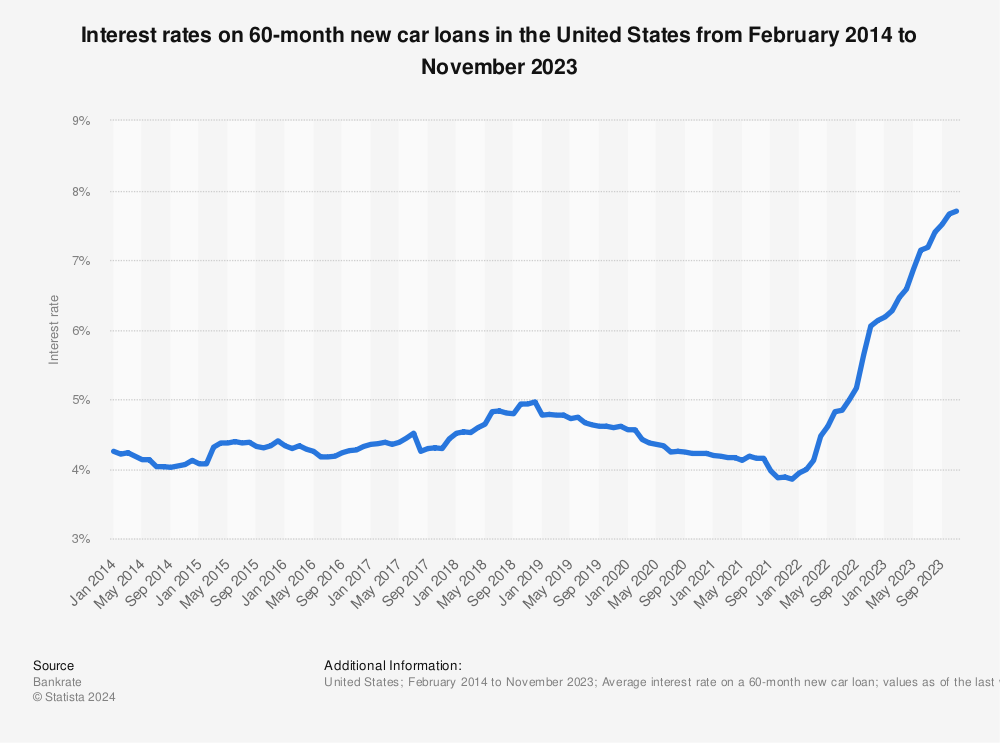

Makes sense, but there’s still hope when it comes to loan rates. According to a report from Bankrate, auto loan rates are predicted to go down to 4.08% in 2021. So far this year, loan rates have continued to decrease, and those looking to trade-in their older vehicles are likely to get a good deal.

How Do Financial Institutions Bring In Loans Now?

For the foreseeable future, those lower auto loan rates are the main factor drawing in potential buyers right now, so it will be important for banks and credit unions to let people know that they will work with the borrower to get a loan that works best for them. Many consumers will still be struggling financially long after this pandemic has passed, so empathy and understanding will continue to be key to your messaging when communicating with potential borrowers. Be sure to reflect this mindset in your marketing and interactions with borrowers. If there’s one thing borrowers are looking for right now, it’s a place where they feel they can be heard and gain a sense of certainty. That will lead to building a trusting relationship with your bank or credit union.