At some point when visiting a retail store, you’ve probably been asked if you want to buy one more of something to earn a special discount or to sign up for their store card in order to earn points on future purchases. These are common methods retailers use to upsell their products and extra services that provide additional value for the consumer.

Auto dealers do this, too, when they’re offering the buyer undercoating or repair deals. They make more money and, lenders can also because it’s often rolled up in the overall cost of the purchase. But net interest margins are being squeezed more each day. Don’t add fees – add value! Open Lending can help you push your interest margins higher. Contact us today to learn how!

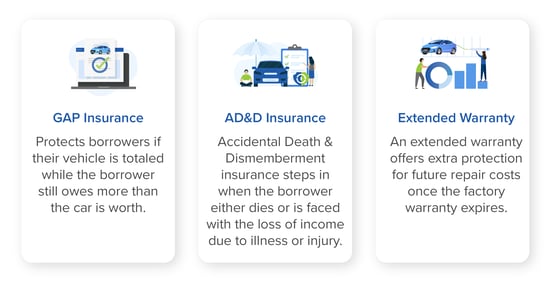

Credit unions can upsell when making an auto loan. Here are a couple of the most popular extra items credit union can pitch to their auto loan borrowers to protect the credit union and its members:

-

GAP insurance protects borrowers should the vehicle be totaled while the borrower still owes more than the car is worth. As we all know, cars lose a lot of value the minute they’re taken off the car dealership lot. In a report from Forbes, the average car depreciates in value by about 49% after five years according to a 2020 study from iSeeCars. Regular auto insurance picks up the value of the car and the GAP insurance covers the rest for very little investment from the consumer, so the borrower and the credit union are protected. First, the borrower doesn’t have to continue paying a loan for which they have no vehicle to use. Second, the credit union’s loan is covered.

-

AD&D insurance, also known as Accidental Death & Dismemberment insurance, steps in when the borrower either dies or is faced with the loss of income due to illness or injury. It protects the borrower and provides the family with peace of mind during difficult times. Again, it’s a smart product, relatively inexpensive and brings noninterest income into the credit union as well. Credit unions can also partner to offer basic auto insurance. Providing end-to-end service that’s convenient to members and can provide credit unions with a new revenue stream is a great opportunity for both!

-

Extended warranties: According to an article from NerdWallet, the most popular item that auto dealers and lenders upsell is the extended warranty. Having extra protection for future repair costs once the factory warranty expires can be an appealing thing to have, especially if a car buyer is planning on keeping their new vehicle for more than three years. It makes sense then that offering this protection from potential costly repairs is at the top of the list for lenders to offer. If a borrower is unable to afford a repair, they could be more likely to split on the loan entirely. And it’s not a one-time opportunity; if your borrower does not take the warranty immediately at purchase, they may determine it’s a smart move when the factory warranty is near expiration.

Each of these options are important extras for consumers as well as lenders. Work with your credit union’s auto loan borrowers to understand what they need now and in the future, while also mitigating your credit union’s risk. Another pro tip: Open Lending offers lenders default insurance. Check it out now!