The Federal Reserve interest rate has a major impact on a financial institution’s bottom line.

By increasing the Federal Funds Rate, the Fed increases the interest rate at which financial institutions can borrow overnight in the federal funds market to meet the reserve requirements. After a year of inflation at nearly 7%, the Fed is expected to raise rates to try to curb inflation.

Though interest rates have been near 0% throughout the course of the COVID-19 pandemic and even before, this will probably be changing soon. 12 of the 18 members of the Federal Open Marketing Committee, which determines the Fed funds rate, expect it to increase by 75 basis points or more in 2022, which tends to be good news for your profit margins.

Lenders will be able to raise interest rates and improve net interest income. And we are due! The last time interest rates had a significant increase was in late 2015. In the following period through 2018, Barclay’s analysts found a 7% to 9% increase in interest income generated across the banking industry.

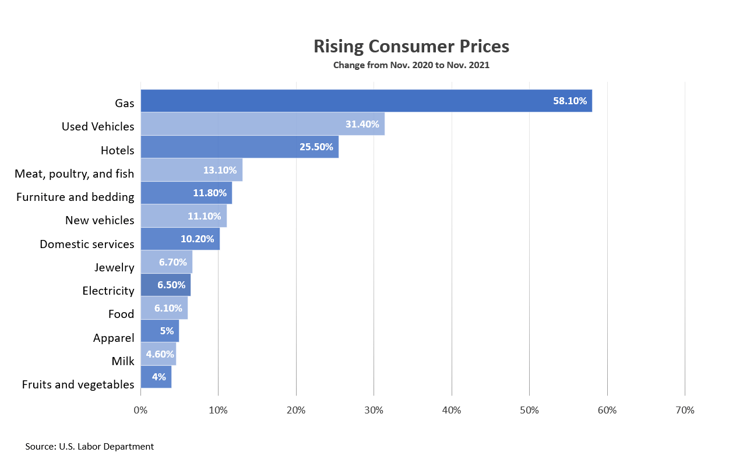

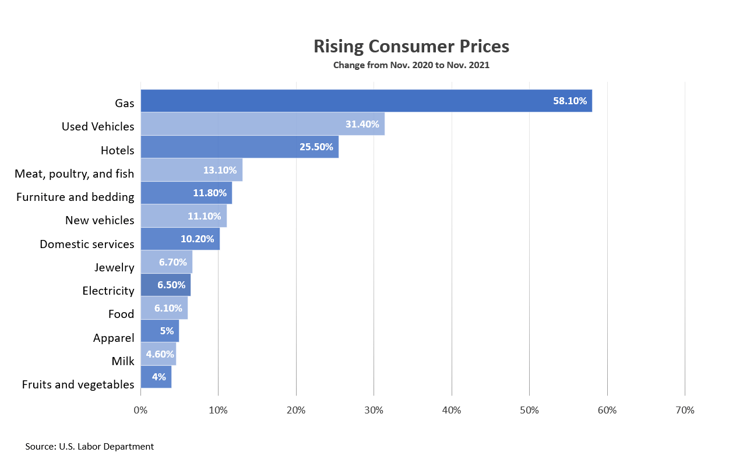

In the current environment, lenders have shifted away from long-term loans such as 30-year mortgages, toward holding more short-term loans in portfolios, and importantly, auto loans. Auto loans are more advantageous than ever for financial institutions to hold. This is because, although vehicle prices have increased across the board, prices have risen disproportionately on cars, especially used cars. The price of new cars has increased by 11.1%, and the price of used cars has swelled a whopping 31.4%. Not only will profit margins increase because of the increase in interest rates, but balances will also grow as a result of the general rise in the average cost of automobiles compared to other goods.

That’s where Open Lending comes in. Our Lenders Protection™ program helps lenders say ‘yes’ to more automotive loans with far less risk. Increase your volume of near-prime auto loan approvals with confidence. As the Fed raises rates, car loan margins will increase, meaning more income for lenders.